There seem to be several mortgage myths floating around that keep cropping up. These myths and misunderstandings about how the home loan process works, and what you need to secure a loan, discourage people who may be perfectly eligible borrowers, from even trying to apply for a loan. They seem to think they’ll get rejected or fail in some way before they even start the process.

Here are the straight facts about some seriously misunderstood mortgage issues:

1. Renting is Cheaper than Owning

It’s easy to do the math on homeownership and decide it’s more expensive to own than to rent, but in most cases, that would be wrong. There are expenses that come with owning a home, such as mortgage payments, property taxes, homeowners insurance, and upkeep, but the equity you are earning in your investment tends to offset the difference.

Paying a mortgage can feel less painful than writing a rent check, since you’re actually putting that money toward something you’ll own at the end of the day. Home values tend to increase over time, and if historical trends continue in California, you’re likely to end up with a house that’s worth more than you paid for it. The average median house price in Placer County has increased from $182,220 in January of 1990 to $472,370 in February of 2018.

Rent adds up quickly, and as soon as you give your notice, you’re left with nothing. As you can see, even if your rent stayed the same over time (and it probably will increase), it usually makes sense to invest in ownership.

2. You can’t get a decent loan unless you’ve got 20% to put down

We get really tired of this myth. A lot of well-qualified families avoid even trying to buy a home because they think they’ll never be able to save up 20% for a down payment. Maybe that wouldn’t be so off putting in the midwest where homes are still relatively affordable, but California is well known for having premium housing prices, and a 20% down payment on a modest single family home can amount to more than the price of a fully-loaded luxury vehicle.

Let’s clear this up right now — You can ABSOLUTELY buy a house with less than 20% down.

In fact, there are great conventional loan programs for borrowers who have as little as 3% to put down. The 20% myth comes from the fact that you have to put at least 20% down to avoid private mortgage insurance (PMI).

You can still buy a house with less than 20% down, you just have to pay mortgage insurance until you pay your mortgage down enough to get rid of it. In California there are also government backed down payment assistance programs that can reduce your down payment even lower than 3%.

3. Thinking you’re stuck with the first company who gives you a pre-approval letter

Nope. You are not committed to a loan until you sign on the dotted line. There are a lot of mortgage companies who would like you to think pre-approval means you’re in some kind of contract with them. It’s just not true.

In fact, the freedom you have as a consumer is why so many pushy loan originators will try to pressure you into thinking you have to act now, or that they are the only ones who can get you a loan. Loan Originators know perfectly well how much freedom you have as a consumer, and the good ones will make sure you are aware of that freedom and power, and not try to hide that from you.

There are a lot of lenders and loan programs available to help you, and one will end up being better suited to your needs than another. It’s your loan officer’s job to work through your options with you, understand what your goals are, and help you align those goals to the loan program that will make the most sense for you.

You can meet with as many loan officers, and review as many loan programs as you want to find the right fit. You should feel comfortable with the person you’re working with, and trust that they have your best interest in their crosshairs. If at any time you feel they don’t, ask questions.

If you don’t like the answers, simply walk away.

You aren’t stuck with that deal until you sign the final paperwork with a notary.

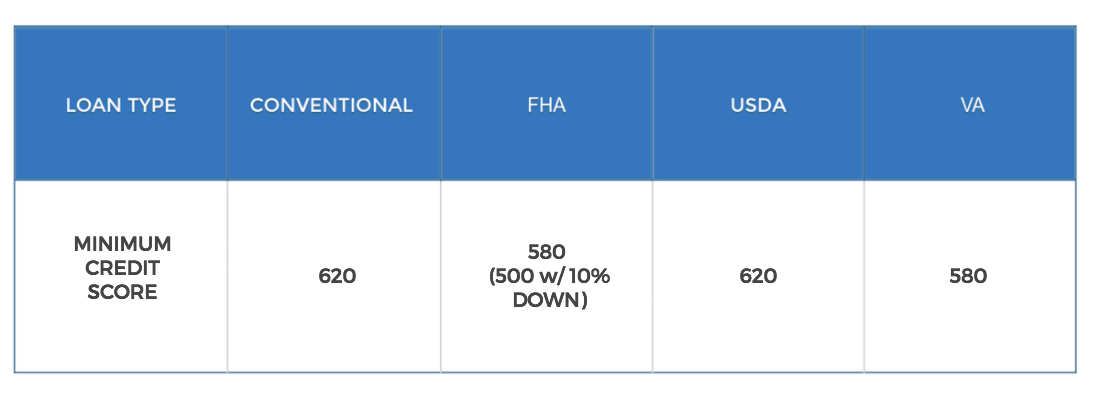

4. Only high credit scores qualify for a home loan

Different types of loans have different minimum credit score requirements. The higher your score, the better your interest rate will likely be, but you can still get a house with a credit score as low as 500, in some instances, depending on the program and how much money you have for a down payment.

Here are the minimum requirements for some of our most popular loan programs as of April 2018:

As you can see, the VA doesn’t even have an official baseline credit score requirement. They leave that up to the individual lenders, and some go as low as 580.

5. Thinking a pre-approval is the same thing as a fully underwritten loan

This mortgage myth is particularly sad. We’ve seen borrowers get a pre-approval letter, go make an offer on a house, and then end up not getting the loan because they sabotaged their loan during the underwriting process.

A pre-approval is not a guarantee of anything. It’s a ballpark estimate based on figures you report, and still hinges on the underwriting process to verify these facts and figures in a deeper-dive into your personal finances. Usually this is a simple process of showing supporting documents, such as pay stubs, and tax returns to prove your ability to pay back a loan over time.

Unfortunately, a lot of unsuspecting borrowers think they’re good to go once they’ve got that pre-approval letter in hand, and wind up making big changes or financial moves that change their eligibility before the loan is finalized. It’s really important to talk to the team helping you with your loan before you make any big moves in your financial life, career, or otherwise while your loan is in process.

A pre-approval is only as good as the person issuing the pre-approval. A certain company right now is touting their 8 minute pre-approval you can obtain online without talking to anyone. That is flat out dangerous.

Consider this: do you think the largest financial purchase of your life, the home you pin your hopes and dreams on should be completed in 8 minutes without ever talking with anyone?

.png)