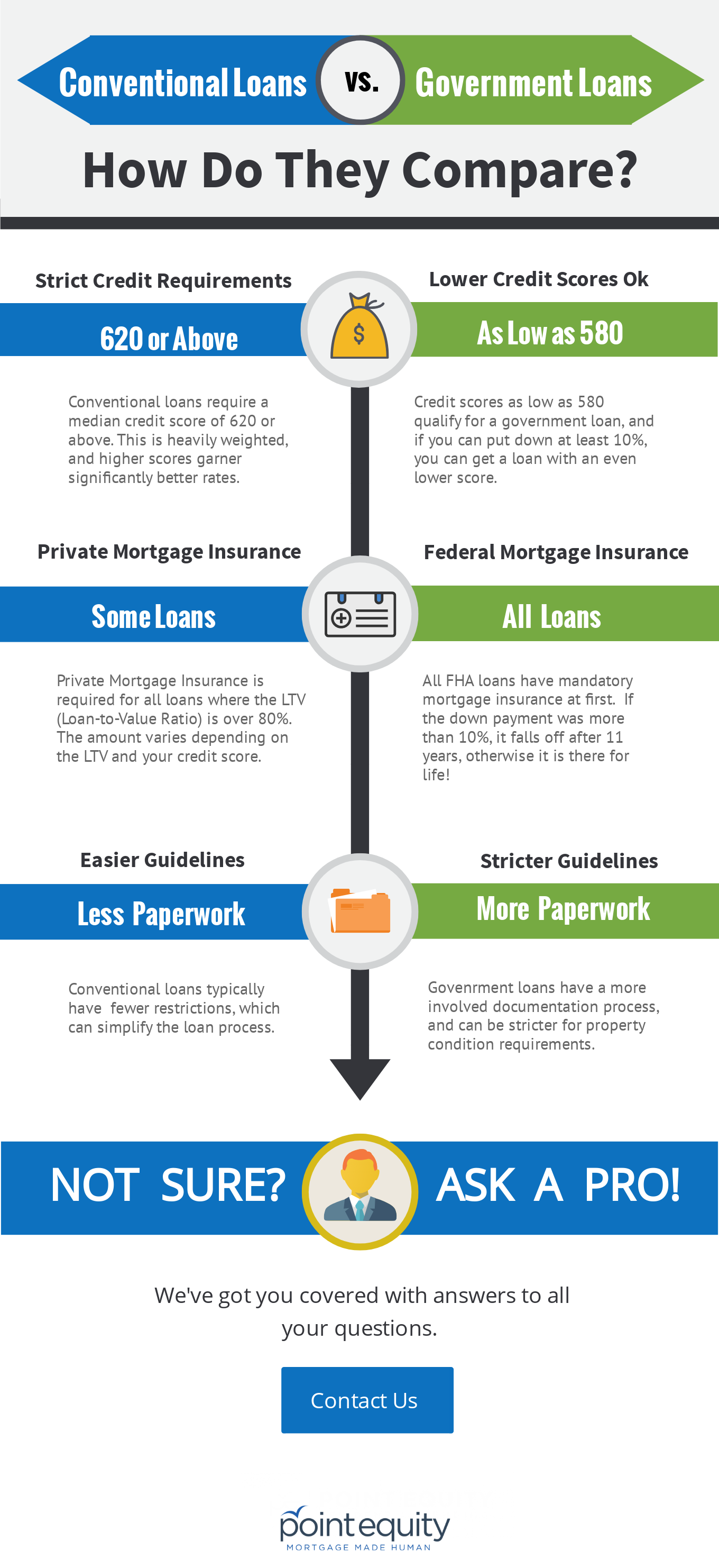

If you’re shopping for loans, you might be wondering what the differences are between conventional and government loans. Or more importantly, how those differences might effect your ability to qualify for a home loan, and save money down the road on mortgage payments.

Here's a simple explanation of the three main differences between conventional and government loans, and what those differences might mean for you as a borrower(jump to the INFOGRAPHIC):

Minimum Credit Score

Conventional Loans - 620 or Above

Conventional loans have a minimum credit score of 620 or above. This is heavily weighted for conventional loans, when compared with government loans, and higher scores garner significantly better interest rates.

Government Loans - As Low as 580

If you have a credit score on the lower end, you might still qualify for a government loan. Median scores as low as 580 qualify, and if you've got at least 10% to put down on the purchase, you can go even lower.

Mortgage Insurance

Conventional Loans - Private Mortgage Insurance

Private mortgage insurance is required for all loans where the LTV (Loan-to-Value Ratio) is over 80%. The amount varies depending on the LTV and your credit score. If you put at least 20% down on your conventional loan, you won’t have to pay private mortgage insurance.

If you opt to put less than 20% down, you’ll pay private mortgage insurance, along with your monthly mortgage payment, until you’ve paid the loan down enough to reach the 80% LTV threshold.

Government Loans - Federal Mortgage Insurance

All FHA loans have mandatory mortgage insurance. Whether it lasts the life of the loan depends on how much money you put down. If you put more than 10% down on your down payment, the mortgage insurance will fall off after 11 years, otherwise it remains for the life of the loan.

Loan Guidelines

Conventional Loans - Easier Guidelines

Conventional loans typically have fewer restrictions which can simplify the loan process. Less paperwork and more lenient guidelines can mean a quicker close, and less waiting to get into your new home.

Government Loans - Stricter Guidelines

FHA loans have more involved documentation process, and can be stricter for property condition requirements. There's a little more paperwork, and the house you intend to buy has to meet a higher quality of standards during appraisal.

Here's the Infographic showing the differences.

.png)