We get this question a lot:

“What is the lowest interest rate I can get for my home loan?”

Everyone wants to know how low they can get their interest rate. When you consider the number of advertisements everywhere screaming about how this bank or that lender can get you the lowest interest rate, it’s no wonder everyone’s primary focus when they start shopping for a home loan is securing the lowest rate possible.

But is there such a thing as an interest rate that’s too low (aka too expensive)?

As shocking as this might seem, the short answer is yes. There are absolutely times when you will actually pay more with a lower interest rate.

How a lower interest rate can cost you more

To understand how this phenomenon works, you have to start with how a person’s interest rate is chosen in the first place.

Let's set the scene...

A person goes to a credit union or bank and applies for a loan. The bank offers them one rate, take it or leave it.

There are a few things that usually go unmentioned:

- There is no single “set” rate, there is always a range

- Banks and credit unions don’t have to openly disclose how much they make on the back end (we will talk about APR a bit later)

- Higher interest rates offer lender credits to pay for closing costs

Let’s talk about the range of rates.

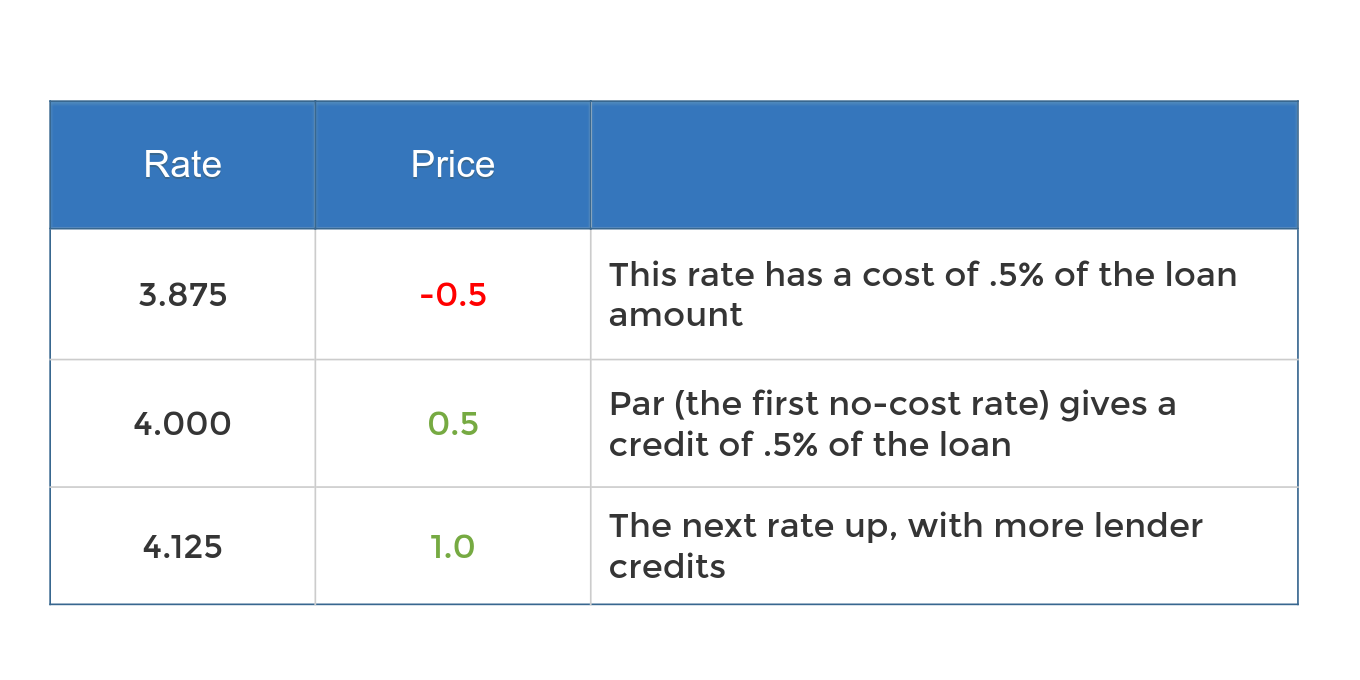

Each bank has a “rate card,” which lists a range of rates and their corresponding “pricing.” They also have a set “par” rate.

Par is the line in the sand that separates costs from credits.

A rate above par will have lender credits, which can be used towards closing costs. A rate below par will have additional costs required at closing to “buy down the rate.”

Here is an example:

These aren’t exact numbers, they are just for illustrative purposes, but they give some insight into how pricing works.

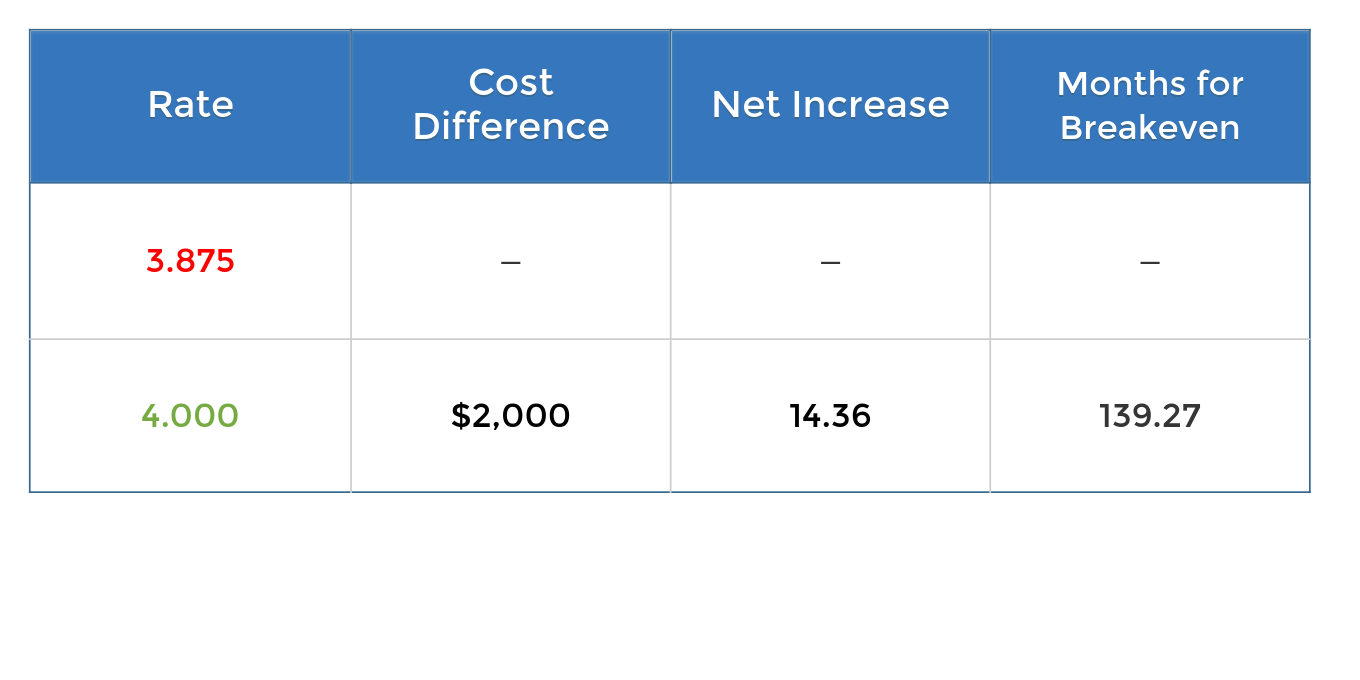

Let’s take a loan amount of $200,000 and see how pricing plays out.

There is usually a bigger jump between par and the rate below par. In this example there is a $2000 difference, because instead of bringing in an extra $1,000 to close the loan, the bank gives you $1,000 to be used towards closing costs. Additional increases or decreases to your rate will add more credits or costs respectively.

Additional factors come into play as well.

Credit scores, loan-to-value ratios, and other factors will shift the pricing up or down. Mortgage brokers have an advantage here, because they aren’t beholden to get their financing from one single bank. They can shop around at different banks to find the best pricing and rate options to fit the needs of their client. Certain banks like certain types of loans; the advantage of a brokerage is they can shop several banks to find the best deal for your type of loan.

But a Higher Interest Rate Costs More Money!

That is absolutely true...over the life of the loan.

Most people outgrow their first homes in 5 or 6 years, and move on. In many instances that’s not enough time to make up the difference in the money you would spend to pay down your loan to a lower rate.

The one constant in life is that life is constantly changing. Even people who buy a house and do indeed live in that house for the rest of their lives change their loan. Usually, it’s for a cash-out refinance, where equity is taken out to pay for home repairs, or a wedding, college tuition, car down payment, etc., the list goes on and on.

The important thing is to work with someone who is willing to take the little bit of extra time to crunch some numbers for you and help you decide whether a buydown or lender credit are better for your long term and short term goals.

Find Your Breakeven Point

It’s best to find the “breakeven” point, where the few extra dollars per month you’d save with a lower interest rate, equals the money you spent to buy down the rate in the first place.

This is where most people tune out, because we are going to talk a little bit about algebra. If you’re not into the details, skip ahead.

Let’s go back to that pricing example, with a loan amount of $200,000 and we can add an extra column for principle and interest payment (pulling a quick quote from a mortgage calculator) along with the net payment increase (compared to 3.875%):

So here comes the algebra question: how many months will it take before the net increase exceeds the money saved in closing?

Take the difference between the cost/credit of two rates, and divide it by the net increase to get the number of months. Here it is as a table:

This means that on the 140th month, it would have been “cheaper” to get the lower interest rate of 3.875%.

That’s 11 years and 8 months!

Imagine what could change in your life during that time.

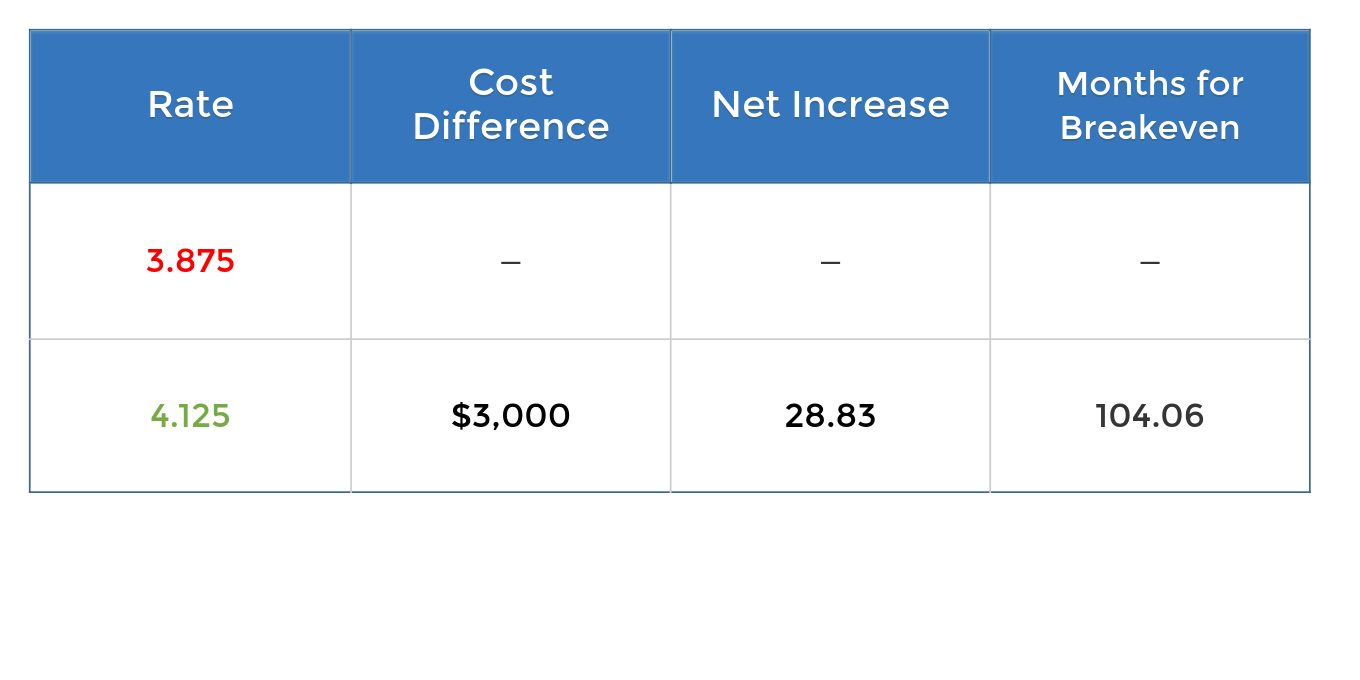

Now let’s compare 3.875% to 4.125%

The number of months is always rounded up, because it will be on the next month’s payment that the breakeven point is met.

That’s 105 months, or 8 years and 9 months, before it has cost more for the expensive rate than in upfront closing costs.

Meanwhile, since $3,000 has been saved in closing costs, that’s $3,000 towards new appliances, or new carpet/flooring. That’s 750 Starbucks drinks, if you consider the average at $4/day. By taking a slightly higher interest rate, you just bought yourself a cup of coffee every day for two years straight.

Everyone has a unique situation. The trick is to make sure you understand your options, or are working with mortgage broker who can help explain the outcomes in a way you’ll understand, so you can get the loan you need, at the rate that most benefits you.

If you have more questions about rates and how they affect pricing, let us know!

.png)