They appeal to a wide variety of borrowers, including:

The option of a fixed, steady mortgage payment make these loans an attractive option for families who want to invest in their future, and consistently predict what their expenses might be in future years.

The term "conventional" refers to loans that adhere to guidelines set forth by Fannie Mae and Freddie Mac. These two large agencies create a secondary market for mortgage backed securities by backing loans with an insurance policy that makes them attractive to large investors across the globe.

Fannie Mae and Freddie Mac are private (although heavily regulated) entities, and this is the primary difference between conventional and government loans; all government loans are ultimately backed and insured by government agencies such as HUD (Housing and Urban Development), USDA (Department of Agriculture), and the VA (Veterans Affairs administration).

It is common and arguably true that, adjustable rate mortgages, non-conforming loans, and jumbo loans are also referred to as conventional loans, but for the purposes of this tutorial, we’re limiting the conversation to conventional conforming loans with a fixed rate.

To clarify—Fannie Mae and Freddie Mac do insure adjustable rates mortgages as well, but we won't be focusing on those products here.

Lenders considering your eligibility for a conventional loan look at several areas of your life on paper, and the type of home you intend to buy with the proposed home loan.

Here’s the quick list of requirements (scroll down for a detailed explanation of each):

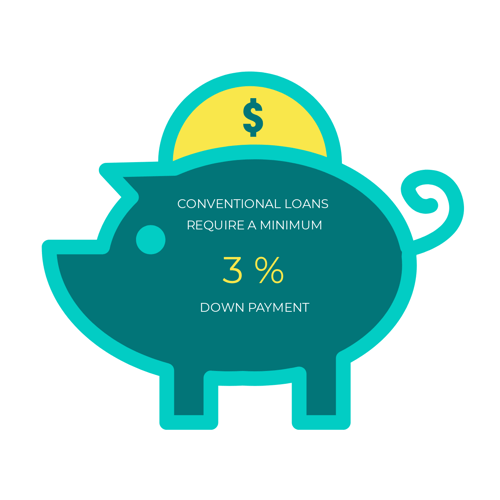

Unlike some government backed loans (such as a VA loan), conventional loans do require some down payment. Rules for how much you need for a down payment change from time to time, and even the rules about how you acquire the money for your down payment can change.

It’s not surprising that confusion exists around how much money you really need to save for a down payment using a conventional loan.

For 2020, conventional loans require a minimum down payment of 3%. It’s a common misconception that you have to have a full 20% down payment to qualify for a conventional loan, and this simply isn’t true.

You can meet the down payment requirement for a conventional loan with as little as 3% down.

But there's a catch:

If you put less than 20% down you’ll have to pay private mortgage insurance (PMI) until you reach 20% equity in the home, according to its original appraised value.

If you come to the table with 20% down payment or more, you can avoid PMI right off the bat, and reduce the overall cost of your loan.

Conventional loans also have a wide range of mortgage insurance options, including lender-paid mortgage insurance where the lender pays the mortgage insurance on your behalf. This is commonly referred to as a no-mortgage insurance loan by aggressive advertising mortgage companies, but that type of advertising is misleading.

Fannie and Freddie require a conforming loan with less than 20% down to have some form of mortgage insurance. Lender paid mortgage insurance builds your mortgage insurance into your interest rate (it’s still there, you just don’t see it on your monthly statement).

Credit score is an important factor that helps determine what type of loan you might qualify for. For conventional loans, your median credit score is required to be above 620. They take the middle score reported by each of the credit reporting agencies, and use that to determine your eligibility.

.png?width=2550&name=Untitled-Project%20(6).png)

What if your score is below 620?

Having a score below 620 doesn’t disqualify you from getting a home loan in general. You can either work on your credit score and bring it up above 620, so you can get a conventional loan, or explore other home financing options, such as an FHA loan, that has a lower minimum credit score requirement.

What if your score is way above 620?

Congrats! Having a considerably higher median score than the minimum 620 can have additional benefits when using a conventional loan. A score as high as 740 or above will help you avoid fees sometimes charged to borrowers whose credit scores are closer to 620.

If your credit score is below 720 and you're putting less than 20% down, you should have a mortgage professional show you a comparison of a government backed loan and a conventional loan to ensure a conventional loan is the best option for your future.

Your credit history is slightly different than your credit score. It’s not so much a number that grades your credit, but a story that outlines the details of your history as an official borrower of money.

What are lenders looking for?

During the underwriting process (when the lender verifies all the info you provided in your loan application), lenders look at your credit report to glean an historical picture of how you’ve treated previous debts in your life.

And there’s a lot more information there than just your credit card payment history.

Your credit report shows anything from student loans to how many recent inquiries there have been on your credit. Underwriters look at these details to help verify your information against your loan application and predict how likely you'll be to pay back any money you borrow from them.

Items that look good in your credit history:

Items that don’t look so hot in your credit history:

A few issues here and there isn’t usually the end of the world, and probably won’t prevent you from getting a conventional loan. The most important thing is to show a pattern of responsible habits in recent history, even if your way-back-when habits weren’t.

Banks put much more emphasis on recent credit history, particularly the past 12 to 24 months. Typically they want a borrower to have two open, good standing accounts that have been established for 12 or more months at the time of application.

Some activity is better than no activity

Make sure you have at least some recent activity.

A credit report with no information on it doesn’t give lenders any clues as to whether you’ll be a good borrower or a lousy borrower, and banks don’t like uncertainty.

Likewise, if your credit is poor, don’t just pay off your debt and vow to never use a credit card again.

The ability to borrow money on credit is a valuable investment tool, and there may come a time when you’d like to use it to leverage a financial opportunity.

If you don’t create a new trend of responsible habits after a slough of not-so-great ones, the only information a lender might have on hand to evaluate your creditworthiness will be decades old mistakes that may not reflect the responsible financial being you have become.

Does a bankruptcy, short sale or foreclosure mean you can’t get a conventional loan?

Lenders prefer you don’t have bankruptcies, short sales, and foreclosures on your report. That doesn’t mean they preclude you from ever getting a conventional loan.

There’s a waiting period afterward, and some exceptions for special circumstances, but eventually you’ll be eligible again.

As of April 2018, the waiting period before you can qualify for a conventional loan after bankruptcy depends on several factors, including the type of bankruptcy you filed for, whether or not a previous home was included in the bankruptcy.

As of April 2018, getting a conventional loan after a foreclosure typically requires you wait 7 years and obtaining a mortgage after a short sale typically takes 4 years. Some banks will make exceptions and shorten this period to 3 years for a foreclosure and 2 years for a short sale if there were extenuating circumstances, such as a death in the family, or serious illness. This exception is taken very seriously and it is difficult to prove verifiable extenuating circumstances.

What if you don’t know what your credit looks like?

Luckily, this is an easy fix. If you’re ready to start shopping for a house, just talk to a mortgage professional who can run your credit, find out what your needs are, and help you sort out which loan options are available to you.

If you’re just starting to think about buying a house, and aren’t ready to talk to someone yet, you can do the research yourself and request a free credit report from each of the credit reporting agencies.

Contact TransUnion, Equifax, and Experian individually, or use annualcreditreport.com to get all three at once.

It’s critical to investigate your credit and monitor changes to your reports, not only so you can plan your home purchase, but also to ensure nothing fishy is going.

Identity theft can happen to anyone, and many people who don’t monitor their credit only find out they have been a victim when they apply for a loan and discover someone else has ruined their good name.

Required cash reserves varies depending upon your credit score, debt to income ratio, and most importantly, occupancy.

Primary homes typically don’t require reserves for FICOs above 680, and only a month or two worth of house payments below that score.

Second homes and investment properties always have a reserve requirement, which varies depending upon the number of financed properties someone owns.

Sourcing your down payment and cash to close

It’s important to make sure any money in your accounts can be traced to its source and explained. Banks will check to see where funds came from, whether it be a gift from a family member, a paycheck, or a withdrawal from your 401K.

You’ll run into problems getting a conventional mortgage if it looks like the money in your account just magically appeared from nowhere.

Deposits less than 50% of your typical monthly income aren’t required to be sourced.

Can you use gift money?

Gift funds are a popular tool borrowers can use to help buy a home. Buyers can use monetary gifts from family or other eligible sources to pad their down payment, or pay closing costs and other fees.

The rules for using gift funds when you borrow with a conventional loan require documentation (usually a letter), and a paper trail to prove where the funds came from.

Rules about who is allowed to gift money depend on which lender is giving you a loan. Some lenders restrict gift funds to only family member donors, while others allow charitable donations from organizations to count as eligible gift funds.

Your lender will have all the details on this, should you decide a conventional loan is right path for you. Guidelines surrounding gift funds are always changing, so check with your mortgage advisor before moving any money.

Banks use debt-to-income ratio to measure how much of your current monthly income is already spoken for by other debts. Getting approved for a conventional loan usually requires your monthly outgoing payments on debt related obligations (including the proposed mortgage you are applying for) doesn’t amount to more than that a set amount of your total income for the month.

Debt to income ratio maximums depend upon several factors, including:

Conventional loans typically require 2 consecutive years of employment at the same job or in the same industry. That means you could have had two or more different jobs in 2 years, but if they were both doing the same type of work, it would be likely be acceptable.

This isn’t a hard-line rule in the conforming loan regulations though, so it’s really more accurate to say that lenders ‘prefer’ to see a consecutive 2-year employment history.

Lenders understand that sometimes gaps in employment history can be easily explained, and sometimes even make you a more qualified candidate.

Common exceptions to the 2-year employment rule often include:

6 month gaps in employment tend to be a sticking point for underwriters and they'll often ask for explanations and documentation to explain the unemployment period.

If you have a large gap in employment in the past 2 years, a current strong employment situation will dramatically help your efforts.

When you buy a home with a conventional loan, it’s not just your financial health lenders will evaluate. The property itself must meet certain criteria to be eligible for a standard conforming loan, and for lenders to consider it a worthy risk.

Conventional loans are for single family residences between 1-4 units and cannot be used to purchase a business, farm, or apartment complexes.

One advantage of using a conventional loan, as opposed to a government backed loan, is the flexibility in type of property you can buy with it.

Government backed loans mostly restrict buyers to owner-occupied properties, whereas conventional loans can be used to purchase a variety of non owner-occupied single family homes.

Property Use

In addition to a primary residence, a conventional residential loan can be used to purchase a:

Rules governing conventional loans limit the amount of money that can be borrowed. A limit is set based on the number of units the house has and the geographic location. The base amount is usually increasing in areas that have a high median price for housing compared to other areas.

Here’s how things look as of April 2018:

2018 maximum base loan amount

Contiguous States, District of Columbia, and Puerto Rico

Units 1 $453,100

Units 2 $580,150

Units 3 $701,250

Units 4 $871,450

Alaska, Guam, Hawaii, and the US Virgin Islands

Units 1 $679,650

Units 2 $870,225

Units 3 $1,051,875

Units 4 $1,307,175

2018 maximum high cost area loan amounts

Contiguous States, District of Columbia,*

Units 1 $679,650

Units 2 $870,225

Units 3 $1,051,875

Units 4 $1,307,175

Alaska, Guam, Hawaii, and the US Virgin Islands

Units 1 $1,019,475

Units 2 $1,305,325

Units 3 $1,577,800

Units 4 $1,960,750

*Note: a few states and Puerto Rico don’t have any high cost areas for 2018

Here in the Roseville and Sacramento area where we have our main offices, we are surrounded by high-value counties like Placer and El Dorado counties, that allow borrowers to obtain financing for the higher-than-average home prices here.

Many areas in Southern California and other popular Central California areas near the San Francisco bay are also included in the list of places with increased loan limits for conventional borrowers.

Maximum borrowing limits vary county by county, so check with your mortgage professional for the most current maximums.

We’re distinguishing between price and value here because that’s how the banks look at it. A person can list their house for any price, but the bank wants to make sure the agreed upon price does not exceed the house’s true market value according to a professional, certified appraiser.

The way the banks look at it, if they’re lending money for a house worth $400,000, it had better be worth at least that much in the real world. In order to be sure their investment in your property is actually as valuable as the seller says it is, they require an appraisal to verify the property’s value.

Before you can close on your loan and get your keys, your future home will have to pass a test: the appraisal.

What happens during the appraisal?

During an appraisal, an independent appraiser comes to the house, inspects and evaluates it and collects data about the house in a report. When they report back, they deliver an appraisal report that estimates what the current value of the home would be on the market.

Here are some of the details an appraiser looks at when assembling this report:

Comments from the appraisers inspection are included, and they compare (comp) at least three homes in the general vicinity that roughly match the details of the house in question. Sold comparables carry much more weight than pending or listed comparables.

What if the house appraises for more or less than the sale’s price?

When determining a home’s value banks use the LOWER of the appraised value or sales price. If a house appraises for more than sales price you can sleep well at night knowing you got an exceptional value on your home but it will not materially change your loan in any manner. If your home appraises for less than the sales price it may or may not affect your loan.

Homes that appraise low may need to have an adjusted sales price or more mortgage insurance might be required if additional down payment is not an option.

Appraisals are a good insurance policy for you as a buyer. The last thing you’d want is to buy a house only to find out you overpaid. An appraisal is a good way for the lender to have assurances their investment in your home is safe, but it also gives you peace of mind knowing you aren’t spending more than you should for a house.

If you’ve read this guide, you’ve got the tools to decide with relative certainty whether this type of home financing is an avenue you’d like to explore further. You understand why a conventional loan might be a benefit, and whether or not your financial position would allow you to buy your home with one.

The first step to apply for a conventional loan is to decide if it is an option for you.

You can evaluate your needs and if these benefits would help you reach your goals:

This is where you’d usually call a mortgage professional you trust to go over your current financial situation, look at your credit, and get pre-approved to see what kind of interest rate you’d qualify for. You and your loan officer would review your goals and numbers, and map out available loan options.

If you’re not quite there, you can still get an idea of your eligibility using the guidelines we’ve explained here. See if you can answer these questions for yourself:

If you have the answers to those basic questions, you’re ready to talk to your loan officer and find out how much you can borrow, and start shopping for a home. With your pre-approval letter in hand, you’ll be prepared to pounce on the right house when you find it, and be home before you know it!

Empower yourself with knowledge to make smart decisions. These helpful tools and resources will help you enjoy the process of getting a home loan, and feel

confident in your financing choices.

.png)

Or why losing your favorite dessert can be like shopping for your dream home. You head out for ...

Purchase, Dream Home, Mortgage Rates, 2025, buying, first time home buyer, mortgage market | 4 MIN READ

To understand why prediction is hard, look no further than a short story about my kids + ice cream. ...

Purchase, Dream Home, Mortgage Rates, 2025, buying, first time home buyer, mortgage market | 4 MIN READ

If you’re considering buying a home in 2025, understanding the market landscape can help you make ...

Purchase, Dream Home, Mortgage Rates, 2025, buying, first time home buyer, mortgage market | 4 MIN READPoint Equity Residential Lending

915 Highland Pointe Dr. Suite 160

Roseville, CA 95678

Fax: (916) 914-2306

info@pointequity.com

Point Equity Residential Lending, NMLS ID 1404205. NMLS Consumer Access Link

Main Office is at 915 Highland Pointe Dr. Suite 160, Roseville, CA 95678. Telephone Number: 916-248-4620. Equal Housing Lender. Licensed in: California (60DBO-56023 & 01987090), Idaho (MBL-2081404205), Washington (CL-1404205). Information, rates, and programs are subject to change without notice and may not be available in all states. This is not an offer to enter into an agreement. All products are subject to credit and property approval.

© Copyright 2020 Point Equity Residential Lending | Privacy Policy | Disclaimer

All information contained herein is for informational purposes only, and while every effort has been made to ensure accuracy, no guarantee is expressed or implied. Any programs shown do not demonstrate all options or pricing structures. Rates, terms, programs, and underwriting policies are subject to change without notice. This is not an offer to extend credit or a commitment to lend. All loans are subject to underwriting approval. Some products may not be available in all states, and restrictions apply. Equal Housing Opportunity.